Backtesting forms a key part of our toolkit, allowing us to simulate our recommended set of mutual funds using historical data to better optimise a strategy and risk parameters.

We test our recommended set of mutual funds against large historical data sets to build a risk-return profile so we can better select the right optimisation strategies and parameters.

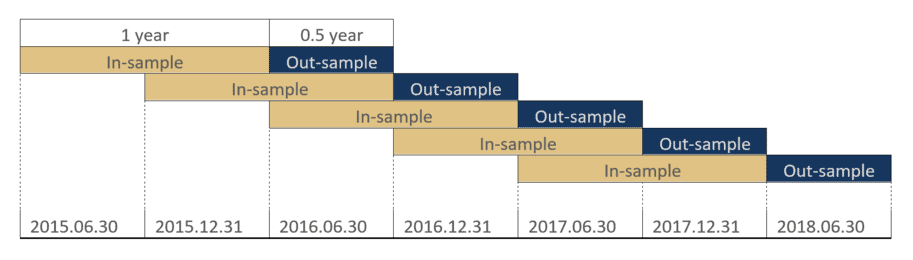

Backtesting gives us a general idea of the potential risk and performance of a given portfolio or asset. We subsequently then progress to walk-forward optimisation. Walk forward optimisation is a robust back-testing methodology that allows for a bias-free testing environment, resulting in a more accurate, predictive outlook. We use walk-forward testing to test our backtested results out-of-sample to better correlate our models with real world performance.

In a nutshell, walk forward testing allows us to train our algorithms on a specific data set (for example data from the years 2010 - 2017) and then validate these algorithms by testing its real world performance out of sample (for example in 2017 - 2022)

Here are a few steps we take to run a walk-forward optimisation

- Consolidate all relevant data

- Break data into multiple sections

- Run an optimisation to find the best parameters on the first piece of data (first in-sample) [train + backtest]

- Apply those parameters on the second piece of data (first out-of-sample) [walk-forward + train]

- Run an optimisation to find the best parameters on the next in-sample data [train + backtest]

- Apply those parameters to the next out-of-sample data [walk-forward + train]

- Repeat until all sections of data are covered

- Collate the performance of all out of sample data

At Berrywise, we run walk forward optimisation to reduce backtest overfitting(also known as curve fitting) in our optimisation and mutual fund recommendation models. Overfitting is a process of designing a trading system that adapts too closely to the noise in historical data that it becomes ineffective in the future.

While backtesting gives us holistic historical outlook, walk-forward optimisations bias free testing environment allows for a predictive, future facing outlook more representative of a strategy’s future performance. Constantly testing and training our algorithms this way allows us to recommend right mutual funds targeting either specific market conditions, investor risk or a shift in market state.